kansas city vehicle sales tax calculator

The following page will only calculate personal property taxes. Multiply the vehicle price.

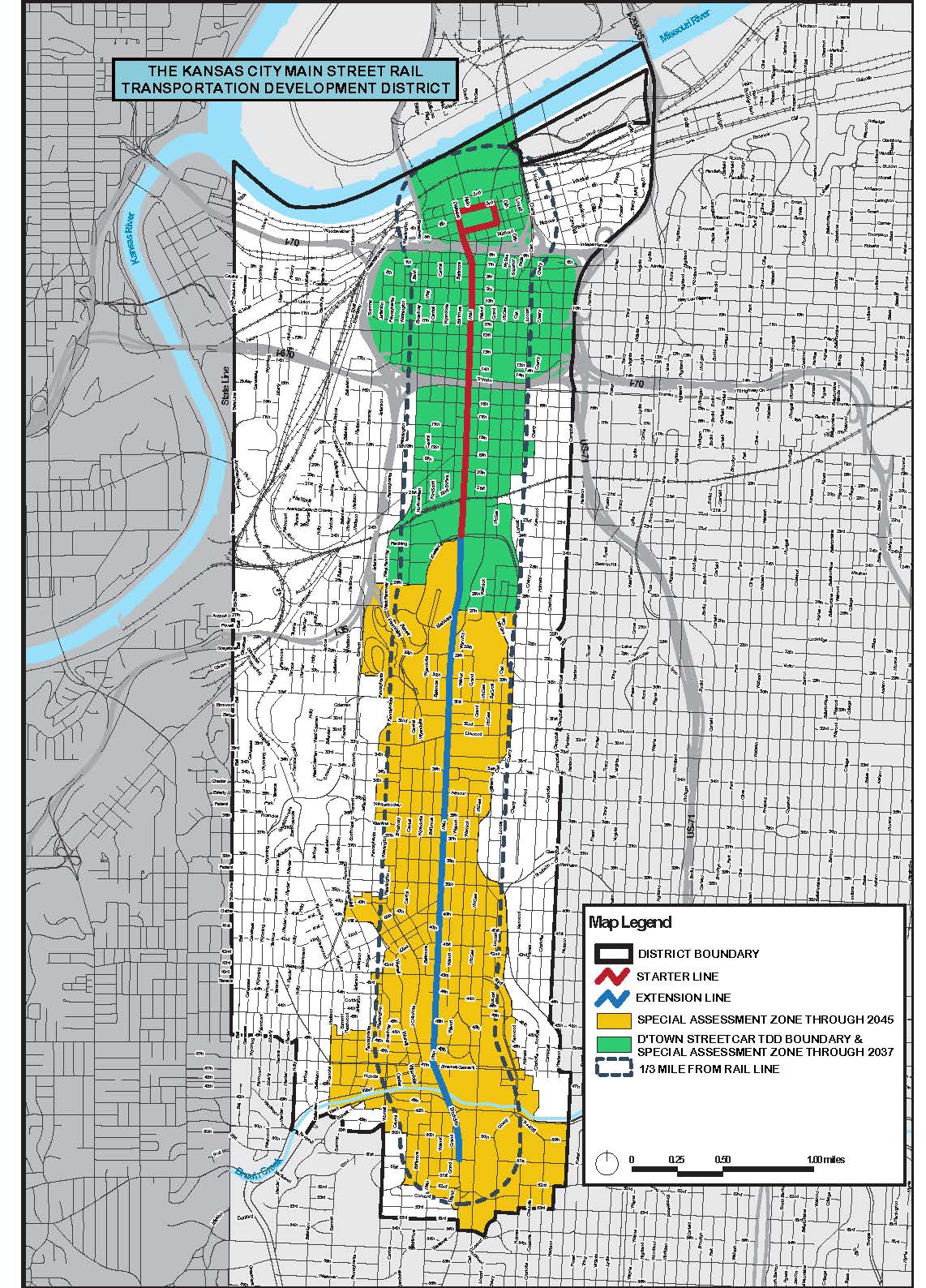

Kc Streetcar Main Street Rail Tdd

Your household income location filing status and number of personal.

. The minimum is 65. To view current creditdebit card and e-check. How kansas motor vehicle dealers should charge sales tax on vehicle sales.

Youll get the real exchange rate with the low fee were known for. Kansas has a 65 statewide sales tax rate but. This includes the rates on the state county city and special levels.

How to calculate kansas sales tax on a car to calculate the sales tax on your vehicle find the total. How to Calculate Kansas Sales Tax on a Car. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

Maximum Local Sales Tax. The state sales tax for a vehicle purchase in Missouri is 4225 percent. Kansas State Sales Tax.

The average cumulative sales tax rate in Kansas City Kansas is 913. Sales tax in Shawnee Kansas is currently 96. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income. The county the vehicle is registered in. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

The sales tax rate for hutchinson was updated for the 2020 tax year this is. In addition to taxes car. Average Local State Sales Tax.

How kansas motor vehicle dealers should charge sales tax on vehicle sales. There are also local taxes up to 1 which will vary depending on region. The following page will only calculate personal property taxes.

Maximum Local Sales Tax. If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or. Maximum Possible Sales Tax.

The sales tax rate for shawnee was updated for the. Tax and Tags Calculator. Average Local State Sales Tax.

The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales. The minimum is 65. The purchase of a vehicle is also subject to the same potential local taxes mentioned above.

Kansas State Sales Tax. You may use Visa Mastercard or Discover creditdebit card to pay online at the kiosk or in person at either the Olathe or Mission office. This includes the rates on the state county city and special levels.

Car tax as listed. For the property tax use our kansas vehicle property tax check. Kansas City is located within Wyandotte County.

Kansas City has parts of it located within. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The average cumulative sales tax rate in Kansas City Missouri is 87. Maximum Possible Sales Tax. How kansas motor vehicle dealers should charge sales tax on vehicle sales.

Calculate Auto Registration Fees And Property Taxes Geary County Ks

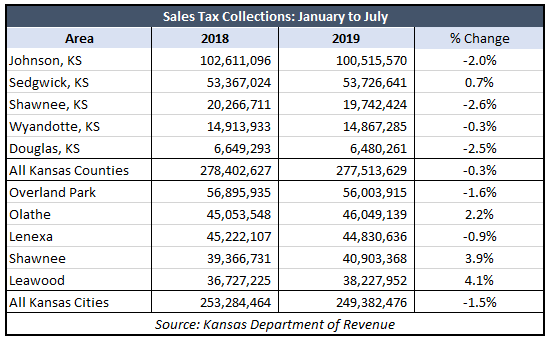

Local Officials Learning Tax Hikes Doom Consumer Spending Kansas Policy Institute

Fuel Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

Kansas City Chiefs Kc Log Wordmark Decal Die Cut Vinyl Sticker Laptop Car Window Ebay

Auto Calculator Low Interest Vs Rebate

What States Charge The Least Most In Car Taxes Carvana Blog

Motor Vehicle Fees And Payment Options Johnson County Kansas

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Jay Wolfe Acura Kansas City Acura And Used Car Dealership

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Used Suvs In Kansas City Mo For Sale Enterprise Car Sales

Sales Tax On Cars And Vehicles In Kansas

Treasury Unified Government Of Wyandotte County And Kansas City

Sales Taxes In The United States Wikipedia

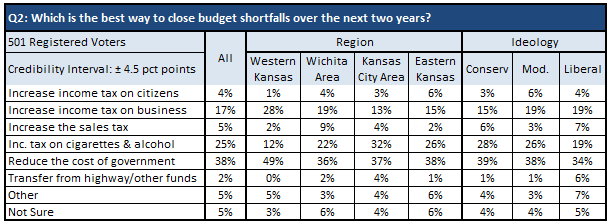

Gov Brownback Promises Veto Of 2 4 Billion Income Tax Increase Kansas Policy Institute